Don’t do crypto. Friends don’t let friends do crypto. Someone should have stopped me.

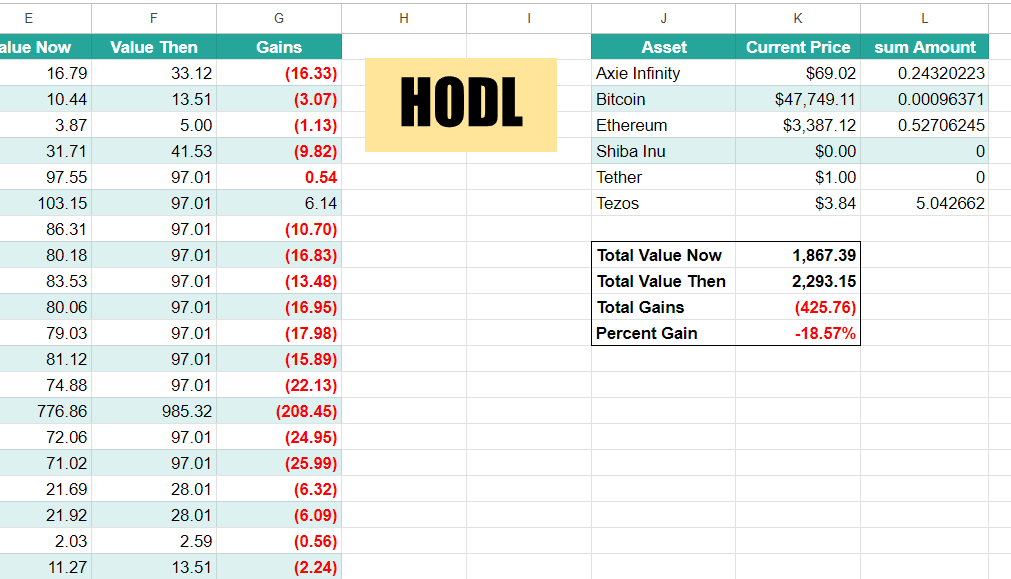

I bought about two thousand dollars of Shiba Inu, Ethereum, Bitcoin and other crypto at the height of the crypto boom. It seemed like it would rise forever, and maybe I could make a few bucks. Sure, I didn’t think that the boom would last forever, but it did seem that it would keep rising, just a little.

And the weird thing is, I did. I did make money.

Ignore that graphic; I shouldn’t have put it up there. Dunno what I was thinking. Things were fine.

2021, a year into the pandemic. If ShibaInu went up just like 1%, everyone would be rich. Bitcoin had doubled and doubled again, it might, maybe, do it again.

I was sitting at this very desk, watching all the green in my spreadsheet, and I told my boyfriend that I would just invest all my savings into Bitcoin, and even if it just went up only 5% in a year, I would be beating the bank interest rate. (Which was stupid low, like near zero, back then and isn’t much better now).

I didn’t do it, though.

Then all crypto crashed.

Then the crypto exchange I used, Coinbase, had all sorts of bad news happening, so I moved my crypto out to my own personal wallet, and every few days, I get an e-mail telling me how much my crypto is worth.

Because I was once a crypto customer, I get e-mails, news alerts and all sorts of cool stuff just so entirely totally wonderfully predicting the wonderful new heights all the crypto will rise to.

These two e-mails don’t say the same thing. One promises the moon. One brings me back to Earth.

Once in the past three years, I came close to getting my money back. I probably should have cashed out then, taken the couple hundred dollars loss, but… it’s just so much fun watching this crypto rise and fall, never, ever going to make me rich or even breaking even, and I just appreciate the expensive lesson.

Don’t. Invest. In. Crypto.

I had bought about $100 of Doge when it was the Hot Coin, and was lucky to sell at $175 or so, but I have never been a gambler. I suppose that works for my benefit, but not a day goes by when I don’t wish I had thrown everything I had into the Dot Com Bubble for at least a little while…

I did make a little money; I got in a month or so before the crash. I just stayed in too long… I’ve never been able to read things like that.

It’s comforting, in a way, because I know if I had gotten into Bitcoin when I first heard about it, back when it was worth a buck or so, I would have sold it all when it got to be like five bucks or something. I’d never have held onto it long enough to get rich, and then I’d be kicking myself the rest of my life over it.

The Dot Com bubble bought me my first house, though. I was working for Symantec at the time and had founder’s stock options, that exploded when the company went public. I immediately cashed in, bought my house and a Miata. Good times.

I messed with mining bitcoin early on. Those hard drives are sitting on my shelf still on the off chance I ever am bothered enough to dig further into them. I had reinstalled windows numerous times so pretty sure the coins are long gone.

I dunno, might be worth taking those HDs down, and seeing if maybe you’re rich 😉

Your tale sounds sort of like how I imagine things would have gone if I ever invested in cryptocurrency.

Cryptocurrency is an interesting thing to know a bit about. But it seems to me that it is even more like gambling than investing in individual stocks on the stock market. Some people get rich from gambling. The vast majority do not. Going ‘all in’ is a sure way to end up in the vast majority.

I rationalized it by saying I could always instantly swap to Tether or another stable coin at the slightest sign of an issue, then swap it back in at the bottom, keep playing the odds without risking anything, always having a place to wait it out. And I did; I did use Tether in that way. But this always assumes that the price will at some point rise.

I was even paying for things with Bitcoin where I could 🙂

All we need is a time machine and we can go back and put all our money into Apple stock on April 17th, 2003 when it was $0.1984/share (according to Google). It is $211.69 as I’m posting this.

I wasn’t yet working at Apple, but a friend was, when they told all the employees they should all buy Apple stock and hold onto it to make the share price rise. And they did, and it did. So, you know, some people got in there.

I headr about bitcoin way way back when on slashdot, and vuagely considered setting up a mining program. It was only worth about 25c a pop back then, and it wasn’t clear how I would spend it so I never bothered. I’m honestly glad I didn’t, because after moving five times since then the odds of me having lost access to all the coins I mined approaches 100%. I am sure I would be completely neurotic about it if I had simply failed to keep track of a million +dollars worth of bitcoin.

However, I do kick myself a bit for not getting in when it hit $1000. I was about 80% certain it was going to keep going up at that point, but I still wasn’t willing to risk $1000 on it. However, I didn’t realize that you could buy fractions of them back then. I would have been quite comfortable risking $500 or so.

Of course even in that scenario, I almost certainly would have sold when it hit 10K, and I’d still be kicking myself. It’s almost like there is no scenario I can envision where I would have realized that these digital objects that exists only to be sold to greater fools could keep going up the way they have . . . .

Looking at the rise and fall of Bitcoin, it hits highs, people cash out, it hits lows, MORE people buy in, leading to a greater high. There was really no reason to believe it wouldn’t happen again, unless the regular people (me) whose money was being transferred to Bitcoin whales (not me) should happen to stop playing the game. I was hoping to just be the n-1th sucker, but I wasn’t that lucky.